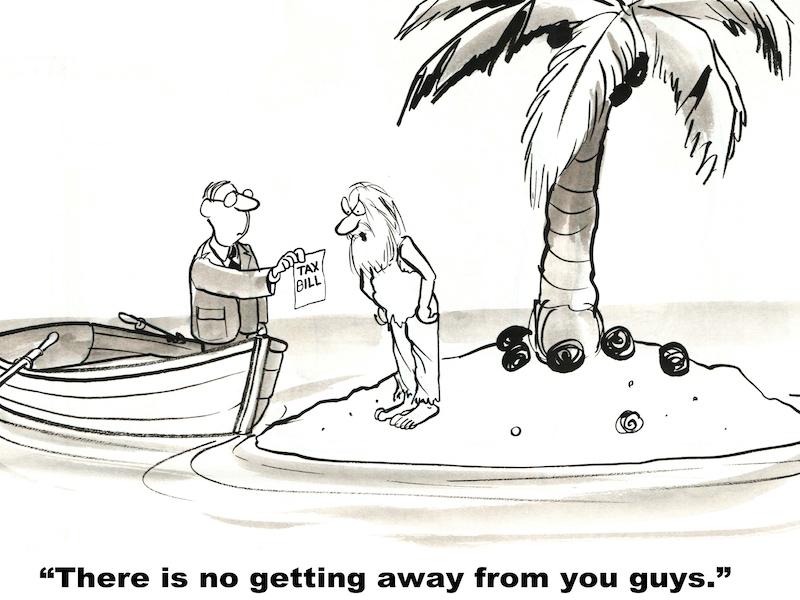

Oi’s legal experts help explain the double-talk on double taxation…

Dear Hadrien and Marijn,

I am an Australian married to a Vietnamese woman. We both live in Thailand where we met each other and where we have worked for separate companies over the last four years. My wife is a ‘resident’ here, which means she has a work permit and pays taxes here. She originally came to Thailand for a fixed term work assignment, but her status has now changed to being effectively employed on “local terms” for an indefinite duration. Does the fact that she has chosen not to de- register from the Vietnamese “family book” change anything with her tax status? Also, I have just received an offer to work on a project in Vietnam for nine months starting from May 2015. Will I need to start paying income tax in Vietnam if I decide to take the job?

Your questions are related to the Vietnamese Law on Personal Income Tax of 2007 (the “Law on PIT”), which was most recently amended in November 2014. The scope of the Law on PIT covers two categories of taxpaying individuals.

First of all, it covers “resident” individuals with taxable income either within or outside the territory of Vietnam. The term “resident” means individuals who are present in Vietnam for a period of at least 183 days calculated within a calendar year or within 12 consecutive months from the date of entry into Vietnam, as well as individuals who have a regular place of residence in Vietnam. This category therefore includes, among others, foreigners who are working in Vietnam.

The second category of individuals falling within the scope of the Law on PIT includes “non-resident” individuals with taxable income arising within the territory of Vietnam. Among others, this category includes foreigners who are not physically present in Vietnam, but who have taxable income in Vietnam nonetheless.

Assuming that her only source of income originates in Thailand, your wife will most probably not fall within the scope of the Vietnamese Law on PIT. She may have to prove her Thai residency, however, which she could do by providing the tax authorities with a residence certificate.

The fact that she did not de-register from the Vietnamese “family book” should not make her a Vietnamese resident for income tax purposes. Instead, the question whether or not she will have to pay income tax in Vietnam will only depend on whether or not she has taxable income arising in Vietnam.

For your personal situation, on the other hand, taking the job will most likely mean that you will fall within the scope of the Law on PIT and that you will be considered as an individual taxpayer in Vietnam.

As is often the case in situations involving a foreign element, a person may actually qualify as an individual taxpayer in more than one country at the same time. In order to avoid such individuals having to pay double personal income tax, to prevent tax evasion and in order to facilitate and promote overseas trade, investment and employment, countries often enter into so-called “double taxation avoidance agreements” (or DTAAs).

The Law on PIT makes it clear that in case of conflict, the provisions of international tax treaties will prevail over any of its own provisions. To date, Vietnam has entered into DTAAs with more than 60 countries, including with many Western countries, but also with Thailand in 1992.

Similar to many other DTAAs around the world, the tax treaty between Vietnam and Thailand provides that where a “resident” of the one country derives income which may also be taxed in the other country, the first mentioned country shall allow as a deduction from the payable income tax an amount equal to the tax paid in the other country.

In the complicated world of taxation, we hope the above will help you understand your situation a little better!

Every month, Hadrien and Marijn answer legal questions from Oi readers. If you have any legal question you want answered, send them to legal@oivietnam.com

*A member of the Paris Bar, Hadrien Wolff has been practicing law in Vietnam for more than seven years, currently as a partner of Audier & Partners based at its HCMC office. Having gained extensive legal experience in the Netherlands and Cambodia, Marijn Sprokkereef is an associate at the Hanoi office of the same firm. Audier & Partners is an international law firm with presence in Vietnam, Myanmar and Mongolia, providing advice to foreign investors on a broad range of legal issues.