There are highs and lows in every small business. But what distinguishes a successful entrepreneur from the crowd is their ability to take calculated risks. One of the key factors of success is making sure your business is financially healthy.

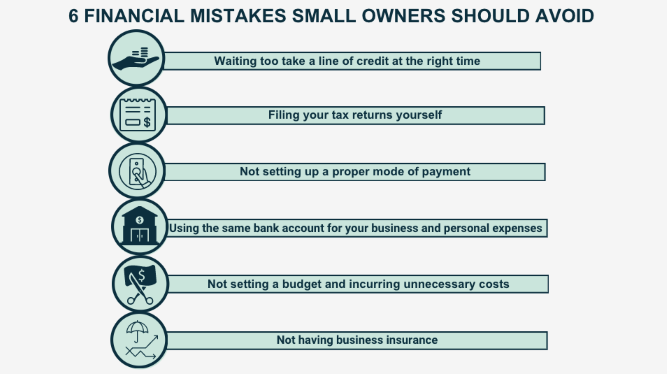

We are not talking about a simple profit loss situation, but rather making sure your small business is not making these money mistakes that new entrepreneurs make:

- Not looking for or taking a line of credit at the right time

If you’re only thinking of taking a line of credit when you are running a loss, it will be very tough to find funding, and pay it back on time.

The best time to seek funding is when your business is doing well so that people and organizations want to invest in it.

There are many ways of seeking credit: from small business loans, venture capitalists, credit cards to new innovative ways like crowd funding your business. You can also apply for a quick personal loan. There are various reliable quick online loan apps nowadays in the market. The type of credit you want depends on the type of business you have, the size of the loan you want, and whether the line of credit will be an equity or debt loan for your company.

- Filing your tax returns yourself

Yes, it’s true that you know your business the best, better than anyone else. But that doesn’t mean you should do your own taxes. Tax season is stressful for everyone, and when you are filing your tax returns for your new business, you must ask a professional to help you figure out the nuances of business taxation. You concentrate on growing your small business.

- Not setting up a proper mode of payment

When you are a new business, you want to make sure you get paid on time, and it’s essential to set up a system where you hand clients a printed invoice and make your financial terms clear before you handle any projects for your clients.

- Having a single spending account for your personal and business use

We all know that starting your small business means you’re at work 24*7. But that doesn’t mean you keep your business and personal finances clubbed together, even if your business is a solo venture.

Having a separate business account for yourself will also help you understand how sound your venture is doing financially, and it will be an easier task to file taxes and ask for a line of credit in the future. This will also shield you from messing up your personal credit score in the future, in the worst-case scenario if your business fails.

Make an effort to create separate savings, checking, and credit card accounts for your business before you start using your personal funds to allocate start-up costs.

- Not setting a budget and incurring unnecessary costs

Even if you are raking in a good profit as a new business, it’s necessary to save up for the future.

Make sure you are not spending your business profits on unnecessary items.

Look at each line of your costs and only spend on essential items. For example, it is okay to forgo the need for fancy office furniture, new coffee machines if you are a new business, even if you are doing well at the moment. Townsville office furniture experts NPS suggest shopping around for the best deals, if you don’t need it you can offered to wait for the best deal. You never know when you will need your cash reserves to tide your small business over financial ebb.

Instead, set a clear budget for your business, so that you can factor in long-term expenses and understand where you might need to spend your money, and how much you need to save.

- Not having business insurance

Business insurance might seem like a lengthy task or an unnecessary expense — but the need for business insurance only becomes too evident when you don’t have it.

It’s best to be on the safe side, and make sure you have the right insurance for your business, from auto insurance, fire insurance, and health insurance that you might need for yourself and the team you work with.

As a small business, you have to keep in mind that carelessness on financial decisions like these may cause your business’s downfall. Have you heard the saying, ‘God is in the details?’

It applies here; you can avoid these mistakes by paying close attention to your business’s finances and carefully evaluating each line of cost and profit.